Do You Have To Claim A Car Purchase On Taxes . Interest on a motor vehicle loan. You may claim the gst incurred on the purchase of a motor vehicle if it is not disallowed under the gst law. Using a section 179 deduction, you can write off all or part of a vehicle purchase as long as the vehicle is new to you and used at least 50% of. You need to account for gst when. If you receive an allowance from your employer. You are only allowed to claim section 179 in the tax year that your vehicle is ready and available for use (even if you do not use the vehicle yet). Plus, you can only claim the section 179 deduction in the year you put the car into service; Keep in mind, commuting from your home to. A car you acquired for personal purposes in 2020 then.

from www.allbusinesstemplates.com

You need to account for gst when. If you receive an allowance from your employer. Keep in mind, commuting from your home to. A car you acquired for personal purposes in 2020 then. Interest on a motor vehicle loan. Using a section 179 deduction, you can write off all or part of a vehicle purchase as long as the vehicle is new to you and used at least 50% of. You are only allowed to claim section 179 in the tax year that your vehicle is ready and available for use (even if you do not use the vehicle yet). Plus, you can only claim the section 179 deduction in the year you put the car into service; You may claim the gst incurred on the purchase of a motor vehicle if it is not disallowed under the gst law.

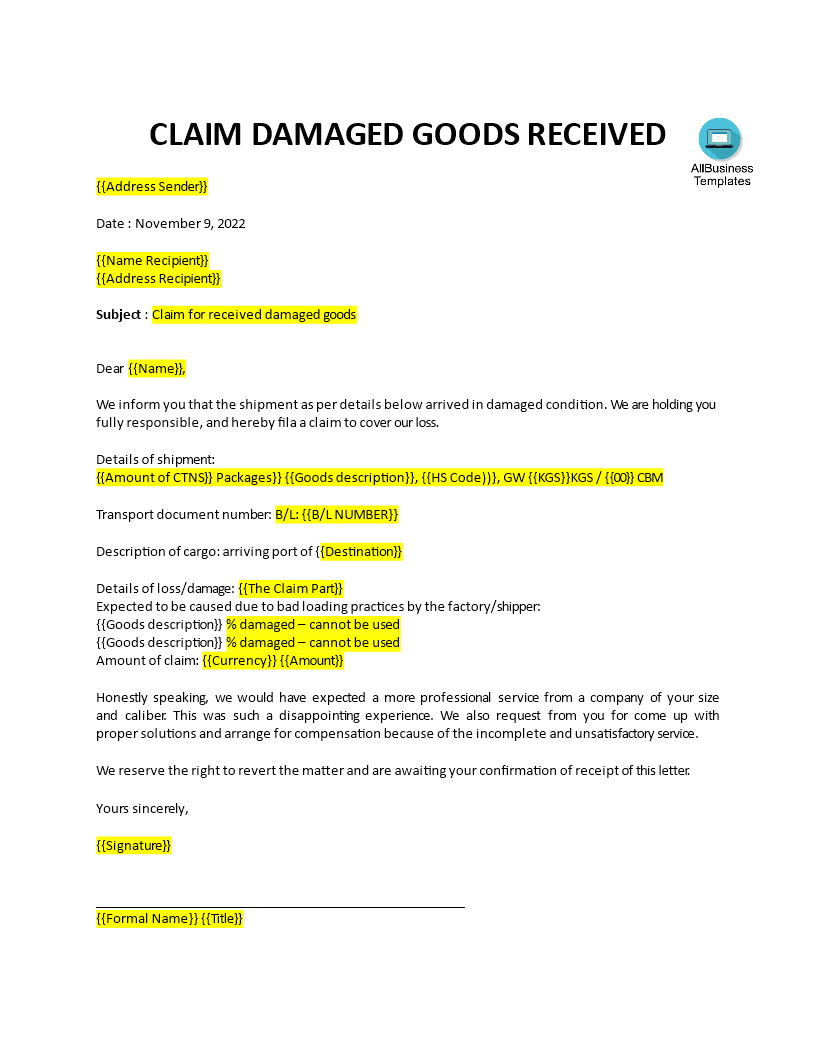

Gratis Damaged Goods Claim Letter Template

Do You Have To Claim A Car Purchase On Taxes A car you acquired for personal purposes in 2020 then. You need to account for gst when. You may claim the gst incurred on the purchase of a motor vehicle if it is not disallowed under the gst law. Interest on a motor vehicle loan. You are only allowed to claim section 179 in the tax year that your vehicle is ready and available for use (even if you do not use the vehicle yet). If you receive an allowance from your employer. Plus, you can only claim the section 179 deduction in the year you put the car into service; Keep in mind, commuting from your home to. Using a section 179 deduction, you can write off all or part of a vehicle purchase as long as the vehicle is new to you and used at least 50% of. A car you acquired for personal purposes in 2020 then.

From kinnamaribelle.pages.dev

Irs W4p 2024 Ilse Rebeca Do You Have To Claim A Car Purchase On Taxes Using a section 179 deduction, you can write off all or part of a vehicle purchase as long as the vehicle is new to you and used at least 50% of. A car you acquired for personal purposes in 2020 then. Plus, you can only claim the section 179 deduction in the year you put the car into service; You. Do You Have To Claim A Car Purchase On Taxes.

From www.facebook.com

Live from SXM! Listen live at and click listen live Do You Have To Claim A Car Purchase On Taxes A car you acquired for personal purposes in 2020 then. Plus, you can only claim the section 179 deduction in the year you put the car into service; Interest on a motor vehicle loan. You may claim the gst incurred on the purchase of a motor vehicle if it is not disallowed under the gst law. You are only allowed. Do You Have To Claim A Car Purchase On Taxes.

From arumraisah.blogspot.com

28+ Claim Sample Letter ArumRaisah Do You Have To Claim A Car Purchase On Taxes If you receive an allowance from your employer. Interest on a motor vehicle loan. You are only allowed to claim section 179 in the tax year that your vehicle is ready and available for use (even if you do not use the vehicle yet). Keep in mind, commuting from your home to. A car you acquired for personal purposes in. Do You Have To Claim A Car Purchase On Taxes.

From authorizationletter.net

4+ Authorization Letter to Claim Templates With Example Do You Have To Claim A Car Purchase On Taxes A car you acquired for personal purposes in 2020 then. Keep in mind, commuting from your home to. You may claim the gst incurred on the purchase of a motor vehicle if it is not disallowed under the gst law. Plus, you can only claim the section 179 deduction in the year you put the car into service; Interest on. Do You Have To Claim A Car Purchase On Taxes.

From kentpclapperxo.blob.core.windows.net

How Do I Claim Tools On My Taxes at Glenda Drummond blog Do You Have To Claim A Car Purchase On Taxes You may claim the gst incurred on the purchase of a motor vehicle if it is not disallowed under the gst law. You are only allowed to claim section 179 in the tax year that your vehicle is ready and available for use (even if you do not use the vehicle yet). Using a section 179 deduction, you can write. Do You Have To Claim A Car Purchase On Taxes.

From www.template.net

Vehicle Purchase Order Template in Microsoft Word, Excel Do You Have To Claim A Car Purchase On Taxes You are only allowed to claim section 179 in the tax year that your vehicle is ready and available for use (even if you do not use the vehicle yet). If you receive an allowance from your employer. Interest on a motor vehicle loan. A car you acquired for personal purposes in 2020 then. You need to account for gst. Do You Have To Claim A Car Purchase On Taxes.

From authorizationletter.net

Sample of Authorization Letter Template To Claim Money Do You Have To Claim A Car Purchase On Taxes You are only allowed to claim section 179 in the tax year that your vehicle is ready and available for use (even if you do not use the vehicle yet). You may claim the gst incurred on the purchase of a motor vehicle if it is not disallowed under the gst law. Keep in mind, commuting from your home to.. Do You Have To Claim A Car Purchase On Taxes.

From cariyengracia.pages.dev

W4 2024 Form Printable Irs Pris Honoria Do You Have To Claim A Car Purchase On Taxes Keep in mind, commuting from your home to. Using a section 179 deduction, you can write off all or part of a vehicle purchase as long as the vehicle is new to you and used at least 50% of. If you receive an allowance from your employer. You need to account for gst when. A car you acquired for personal. Do You Have To Claim A Car Purchase On Taxes.

From lotussmart.com.au

How to Claim Tax Deductions for Car Expenses in Your Tax Return Do You Have To Claim A Car Purchase On Taxes Using a section 179 deduction, you can write off all or part of a vehicle purchase as long as the vehicle is new to you and used at least 50% of. Interest on a motor vehicle loan. Keep in mind, commuting from your home to. A car you acquired for personal purposes in 2020 then. You may claim the gst. Do You Have To Claim A Car Purchase On Taxes.

From mavink.com

Sample Authorization Letter To Claim Do You Have To Claim A Car Purchase On Taxes You are only allowed to claim section 179 in the tax year that your vehicle is ready and available for use (even if you do not use the vehicle yet). You may claim the gst incurred on the purchase of a motor vehicle if it is not disallowed under the gst law. If you receive an allowance from your employer.. Do You Have To Claim A Car Purchase On Taxes.

From amandibcynthea.pages.dev

Irs W4 Form 2024 Fillable Dara Felecia Do You Have To Claim A Car Purchase On Taxes Plus, you can only claim the section 179 deduction in the year you put the car into service; You need to account for gst when. You may claim the gst incurred on the purchase of a motor vehicle if it is not disallowed under the gst law. You are only allowed to claim section 179 in the tax year that. Do You Have To Claim A Car Purchase On Taxes.

From www.allbusinesstemplates.com

Gratis Damaged Goods Claim Letter Template Do You Have To Claim A Car Purchase On Taxes If you receive an allowance from your employer. Plus, you can only claim the section 179 deduction in the year you put the car into service; Using a section 179 deduction, you can write off all or part of a vehicle purchase as long as the vehicle is new to you and used at least 50% of. You need to. Do You Have To Claim A Car Purchase On Taxes.

From elfieqjacinta.pages.dev

Do Electric Bikes Count As Vehicle 2024 Taxes Olia Joscelin Do You Have To Claim A Car Purchase On Taxes You are only allowed to claim section 179 in the tax year that your vehicle is ready and available for use (even if you do not use the vehicle yet). Interest on a motor vehicle loan. If you receive an allowance from your employer. A car you acquired for personal purposes in 2020 then. You may claim the gst incurred. Do You Have To Claim A Car Purchase On Taxes.

From www.ipbcustomize.com

Process Of Insurance Claim For Car Cuztomize Do You Have To Claim A Car Purchase On Taxes Using a section 179 deduction, you can write off all or part of a vehicle purchase as long as the vehicle is new to you and used at least 50% of. Plus, you can only claim the section 179 deduction in the year you put the car into service; If you receive an allowance from your employer. You may claim. Do You Have To Claim A Car Purchase On Taxes.

From belogimannabila.blogspot.com

Insurance Claim Letter Sample Master of Template Document Do You Have To Claim A Car Purchase On Taxes You may claim the gst incurred on the purchase of a motor vehicle if it is not disallowed under the gst law. Interest on a motor vehicle loan. If you receive an allowance from your employer. You need to account for gst when. A car you acquired for personal purposes in 2020 then. Using a section 179 deduction, you can. Do You Have To Claim A Car Purchase On Taxes.

From templatelab.com

42 Printable Vehicle Purchase Agreement Templates ᐅ TemplateLab Do You Have To Claim A Car Purchase On Taxes You may claim the gst incurred on the purchase of a motor vehicle if it is not disallowed under the gst law. Using a section 179 deduction, you can write off all or part of a vehicle purchase as long as the vehicle is new to you and used at least 50% of. You are only allowed to claim section. Do You Have To Claim A Car Purchase On Taxes.

From www.facebook.com

Live from SXM! Listen live at and click listen live Do You Have To Claim A Car Purchase On Taxes You need to account for gst when. Keep in mind, commuting from your home to. You are only allowed to claim section 179 in the tax year that your vehicle is ready and available for use (even if you do not use the vehicle yet). You may claim the gst incurred on the purchase of a motor vehicle if it. Do You Have To Claim A Car Purchase On Taxes.

From mungfali.com

Authorization Letter Sample Claiming Do You Have To Claim A Car Purchase On Taxes You may claim the gst incurred on the purchase of a motor vehicle if it is not disallowed under the gst law. You are only allowed to claim section 179 in the tax year that your vehicle is ready and available for use (even if you do not use the vehicle yet). Interest on a motor vehicle loan. A car. Do You Have To Claim A Car Purchase On Taxes.